Ways to Finance Your Amazon Business in 2024

You need to be aware of payout delays and the cash flow challenges. Without reliable funding, scaling your business or navigating market changes becomes difficult. Fortunately, several financing options are available—including Amazon-specific solutions and traditional methods. In this guide, we'll outline ways to finance your Amazon business so you can choose the funding solution that best fits your needs.

Why Financing Matters for Amazon Sellers

Cash flow is the lifeblood of your Amazon business. Timely access to funds allows you to:

-

Restock Inventory: Keep popular items in stock to meet customer demand.

-

Invest in Marketing: Promote your products to reach a wider audience.

-

Expand Offerings: Introduce new products to grow your business.

Understanding your financing options ensures you have the resources to maintain and grow your Amazon store.

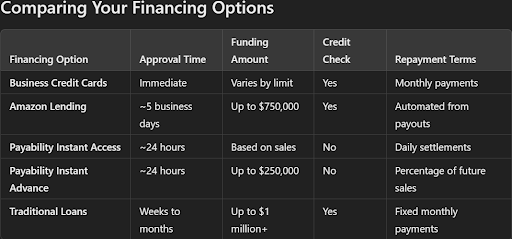

Option 1: Business Credit Cards

Benefits of Using Credit Cards

Business credit cards let you make purchases on credit while earning rewards like cashback or travel points.

-

Flexibility: Use credit for various business expenses.

-

Rewards Programs: Benefit from cashback and other incentives.

-

Build Business Credit: Establish a credit history for your business.

Considerations

-

Credit Limits: May not cover large investments.

-

Interest Rates: High if balances aren't paid in full.

-

Timely Payments: Avoid late fees and interest by paying on time.

Option 2: Amazon Lending

What is Amazon Lending?

Amazon Lending is an invite-only program offering business loans and lines of credit to qualifying sellers.

-

Loan Amounts: Up to $750,000.

-

Convenient Repayment: Automated deductions from your Amazon payouts.

-

Quick Decisions: Approvals typically within five business days.

Eligibility

-

Performance Metrics: Steady sales growth and high customer satisfaction.

-

Invitation Required: Only sellers who receive an offer in Seller Central can apply.

Option 3: Payability Instant Access

Accelerate Your Cash Flow

Payability's Instant Access provides next-day payouts for your Amazon sales, eliminating the standard two-week wait.

-

Get Paid Faster: Receive 80% of your daily sales the next business day.

-

No Credit Checks: Approval based on sales history and account health.

-

Easy Qualification: At least three months of selling history and $2,000 in monthly sales.

Benefits

-

Immediate Reinvestment: Quickly restock inventory or invest in advertising.

-

Multi-Channel Support: Includes sales from other marketplaces like Walmart or Newegg.

Option 4: Payability Instant Advance

Unlock Future Earnings Now

Instant Advance gives you a lump sum—up to $250,000—based on your future sales.

-

Fast Funding: Get funds in as little as 24 hours.

-

No Debt Incurred: Not a loan, so you avoid taking on debt.

-

Flat Fees: No compounding interest to worry about.

Use Cases

-

Bulk Inventory Purchases: Take advantage of supplier discounts.

-

Marketing Campaigns: Boost product visibility with paid advertising.

-

Business Expansion: Invest in new product lines or markets.

Option 5: Traditional Financing Options

SBA Loans and Bank Term Loans

Traditional financing offers larger loan amounts and longer repayment terms but comes with stricter requirements.

Pros

-

Low Interest Rates: More affordable over the long term.

-

High Loan Amounts: Up to $1 million or more.

-

Extended Repayment Terms: Manageable monthly payments over several years.

Cons

-

Lengthy Application Process: Can take weeks or months.

-

Strict Qualifications: Requires good personal credit and extensive documentation.

-

Lower Approval Rates: Especially for newer or smaller businesses.

How to Choose the Right Financing Solution

Consider the following factors:

-

Urgency: How quickly do you need the funds?

-

Amount Needed: Are you making a small purchase or a significant investment?

-

Repayment Terms: What repayment schedule aligns with your cash flow?

-

Qualification Requirements: Do you meet credit or sales history criteria?

Conclusion

Financing is a critical component of growing your Amazon business. Whether you need immediate cash flow solutions like Payability's Instant Access or are considering long-term investments through traditional loans, the right financing can propel your business forward.

If you need personalized guidance or help fine-tuning your strategies, Superfuel AI can assist. Our AI-powered assistant analyzes 36+ key Amazon metrics to identify and address the root causes of sales fluctuations, helping you optimize your storefront and boost sales. Reach out to us at support@superfuel.io.

--

Ben Mathew, Amazon Expert

Ben Mathew is a co-founder at Superfuel, a sales assistant for Amazon sellers. In the past, Ben and his team of e-commerce specialists and software engineers have launched 40+ new brands on Amazon, taking them from zero to bestsellers. In his free time, he is either learning from other top sellers or encouraging his 3 daughters in their love for reading. He is reachable at ben [at] superfuel.io.

FAQs

What is Payability, and how does it benefit Amazon sellers?

Payability provides financing solutions like Instant Access and Instant Advance, offering Amazon sellers faster access to their earnings without the need for credit checks.

How does Payability differ from traditional loans?

Payability offers cash flow solutions based on your sales performance, not loans. This means no debt or interest—just flat fees and quicker access to your funds.

Can I use Payability if I sell on multiple marketplaces?

Yes, Payability considers your entire eCommerce portfolio, including other marketplaces like Walmart or Shopify, to maximize your funding amounts.

What are the requirements to qualify for Payability's services?

For Instant Access, you need at least three months of selling history and $2,000 in monthly sales. Instant Advance requires nine months of history and $10,000 in monthly sales.

Are there any hidden fees with Payability?

No, Payability charges a flat fee with no hidden costs or compounding interest.